Loading...

Depending on your needs, KiiBank borrowing ranges from overdraft to fixed terms loans

Sign up for an account with KiiBank and upload a valid form of ID and your photo

Use your account regularly to receive money, pay for services, make transfers, etc.

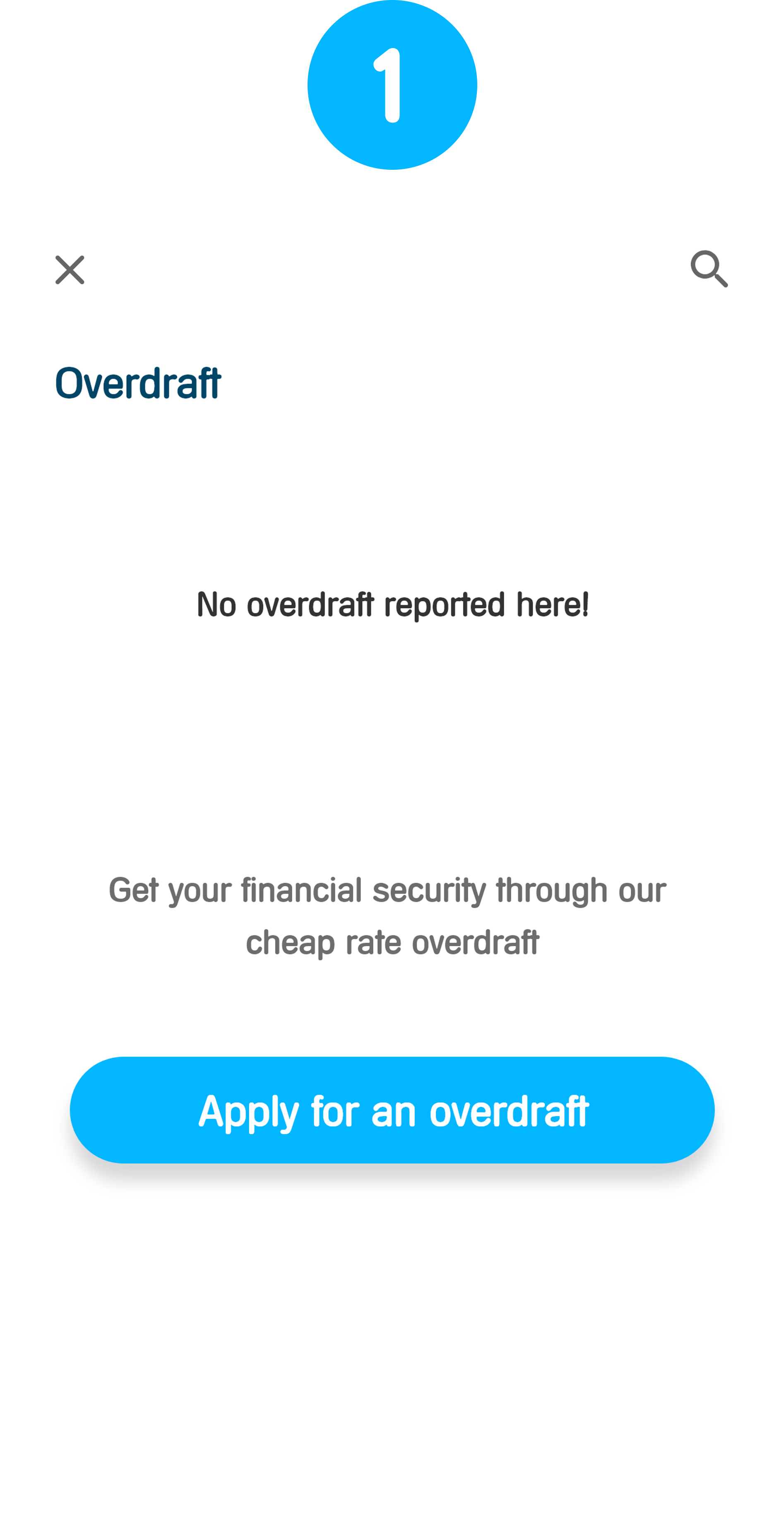

We'll automatically offer you an overdraft!

2 Easy steps to get money available to you when needed the most

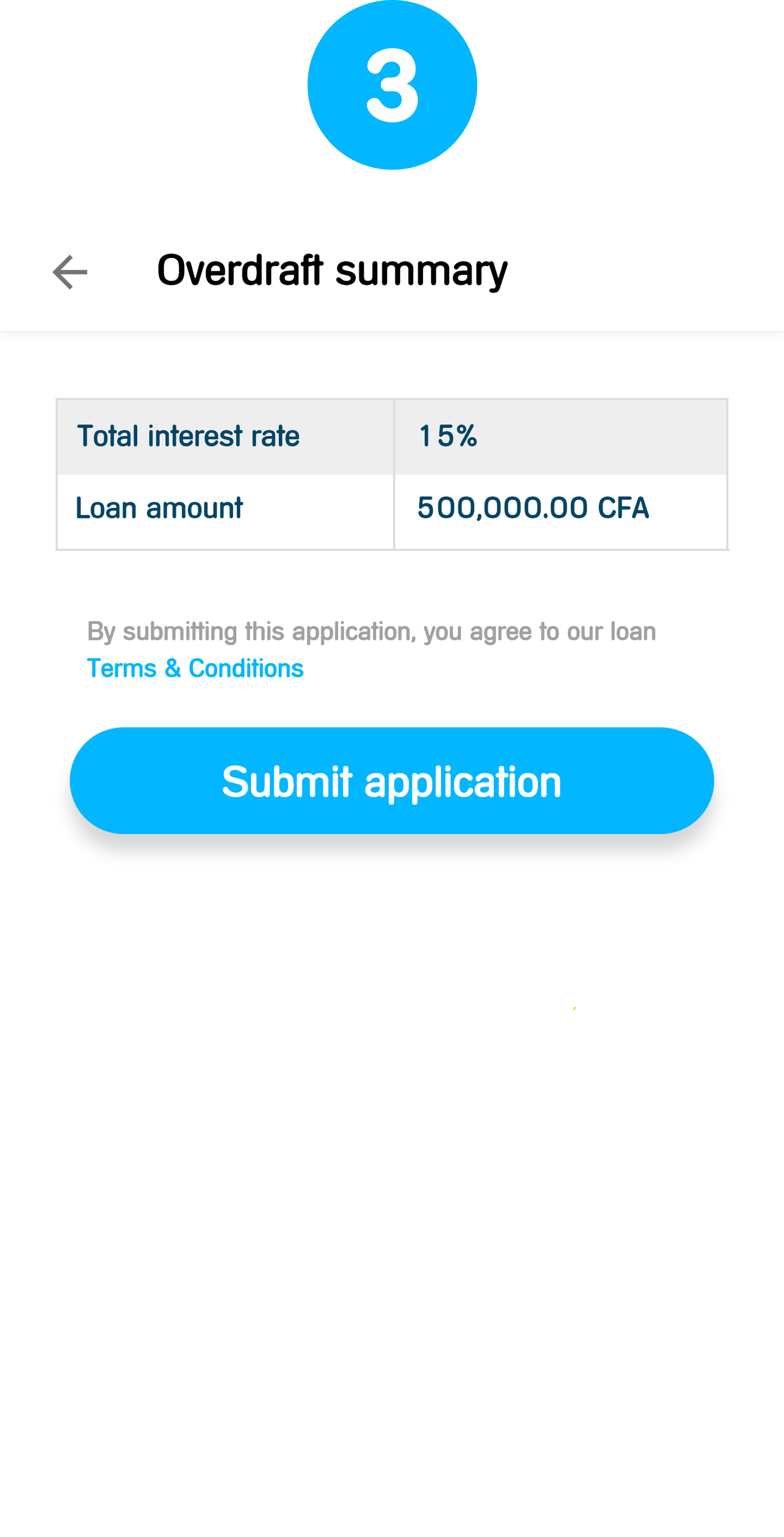

KiiBank will only offer you an amount that does not exceed the amount you are eligible for. If you opt into the overdraft, you agree to be subjected to the terms and conditions of this letter.

We are extending this overdraft to you on the condition that we get a satisfactory credit report on you as well as additional verification checks. We reserve the right to take back our overdraft offer if the previously mentioned checks aren’t satisfactory.

As long as you haven’t used the overdraft, you may reject this offer within a period of three (3) business days. You will not be charged any fee for this.

You must repay the overdraft and the Interest on or before the Maturity Date, and KiiBank is authorised to automatically debit your account on the Maturity Date to settle the overdraft and any accrued interests i.e. the Outstanding Balance.

If you don’t pay the Outstanding Balance in full by the Maturity Date, the overdraft will be treated as being in arrears and any credit in your Account will automatically be debited by KiiBank to settle your Outstanding Balance.

In addition to the above, in some instances, KiiBank might require you to repay the Outstanding Balance in full (or in part) on demand by issuing a repayment notice of at least seven (7) business days.

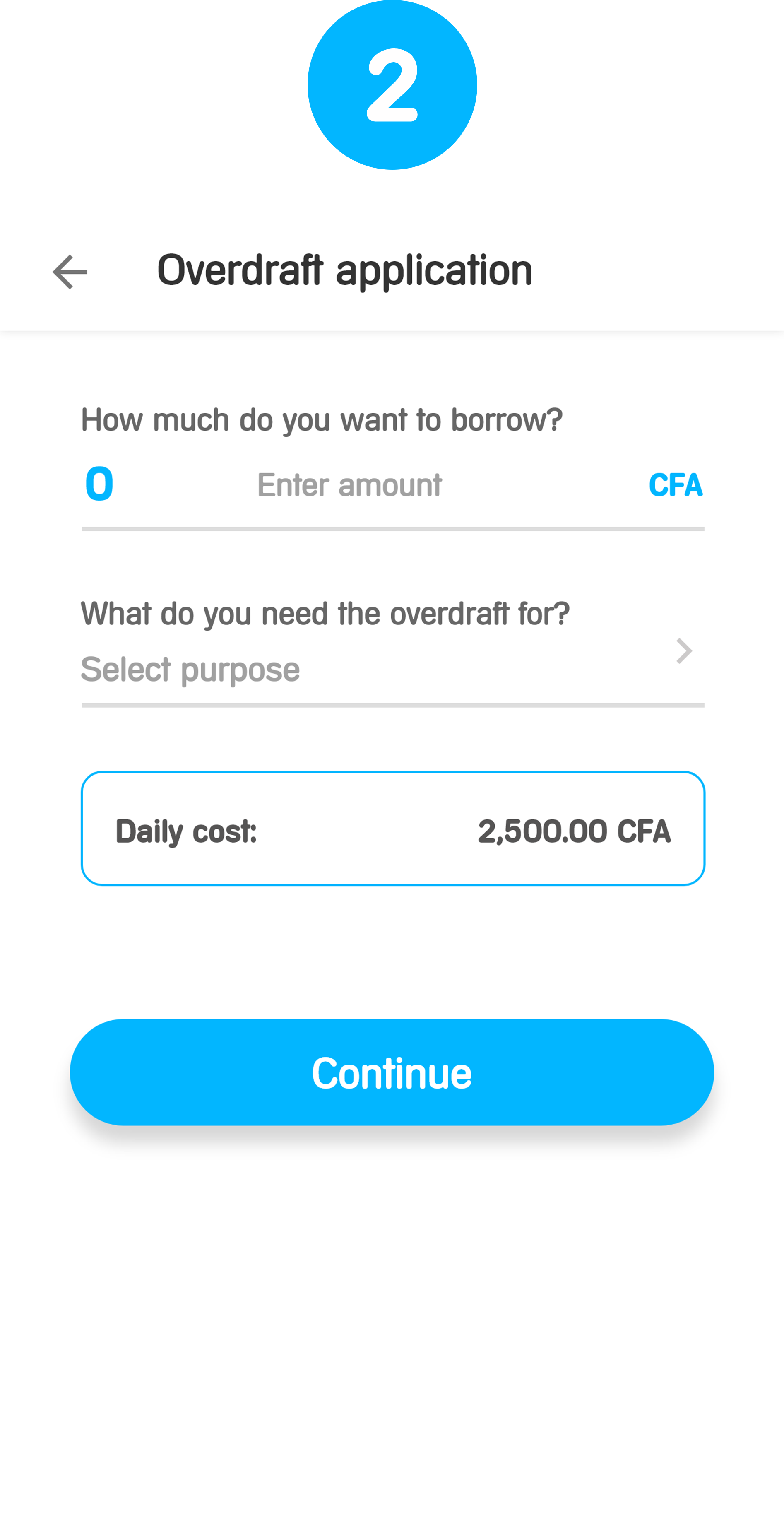

KiiBank will charge you interest on a daily basis at the rate of 0.3% of the amount overdrawn during the duration (Tenor) of the overdraft. This interest will only be applicable and begin to accrue if you don’t pay back by midnight on the Disbursement Date.

KiiBank represents and warrants that we are duly incorporated and licensed under Cameroon law and have taken all necessary actions to authorise our entry into this Offer Letter.

You represent and warrant that:

If any of the following events occurs, the outstanding amount on your overdraft become immediately due and needs to be paid:

If you do not repay the overdraft as expected and KiiBank chooses to impose a default charge, KiiBank will notify you on the first day of default that the default charge will be applied to your account after three (3) days from the date you should have repaid the Outstanding Balance.

If you do not repay the Outstanding Balance within the Tenor, KiiBank may take legal action against you and all expenses incurred in recovery (including legal fees) will be added to the Outstanding Balance.

You hereby authorise KiiBank that, in the event that you default in repaying the Outstanding Balance on our overdraft offer, KiiBank will instruct the other banks/participating financial institutions about your default

By signing this Offer and by taking the Overdraft, you agree to repay when the overdraft is due.

If you fail to repay the Overdraft and the Interest prior to the end of the Tenor, and it becomes delinquent, KiiBank has the right to report to the COBAC, MIFI or by any other means.

You agree that KiiBank has power to set-off your indebtedness under this Offer from all your account balances at other banks and from any other financial assets belonging to you in the custody of any bank.

You also agree to waive any right of confidentiality whether arising under common law or statute or in any other manner whatsoever and irrevocably agree that you shall not argue to the contrary before any court of law, tribunal administrative authority or any other body acting in any judicial or quasi-judicial capacity.

KiiBank can change, add to, delete or replace the terms of this Offer at any time and will notify you about those changes after which they shall become effective.

In the event that KiiBank varies the rate of interest payable on the Overdraft, we will let you know ten (10) days before the implementation of the said variation.

You may not assign or transfer all or any of the rights, benefits or obligations of this Offer to any other person. However, with notice to you, KiiBank may at any time assign or transfer all or any of our rights, benefits and obligations under this Offer to any person.

The status of the Overdraft will be contained in the monthly statements sent you in respect of your Account. In addition, KiiBank may also provide separate statements in respect of the Overdraft to you.

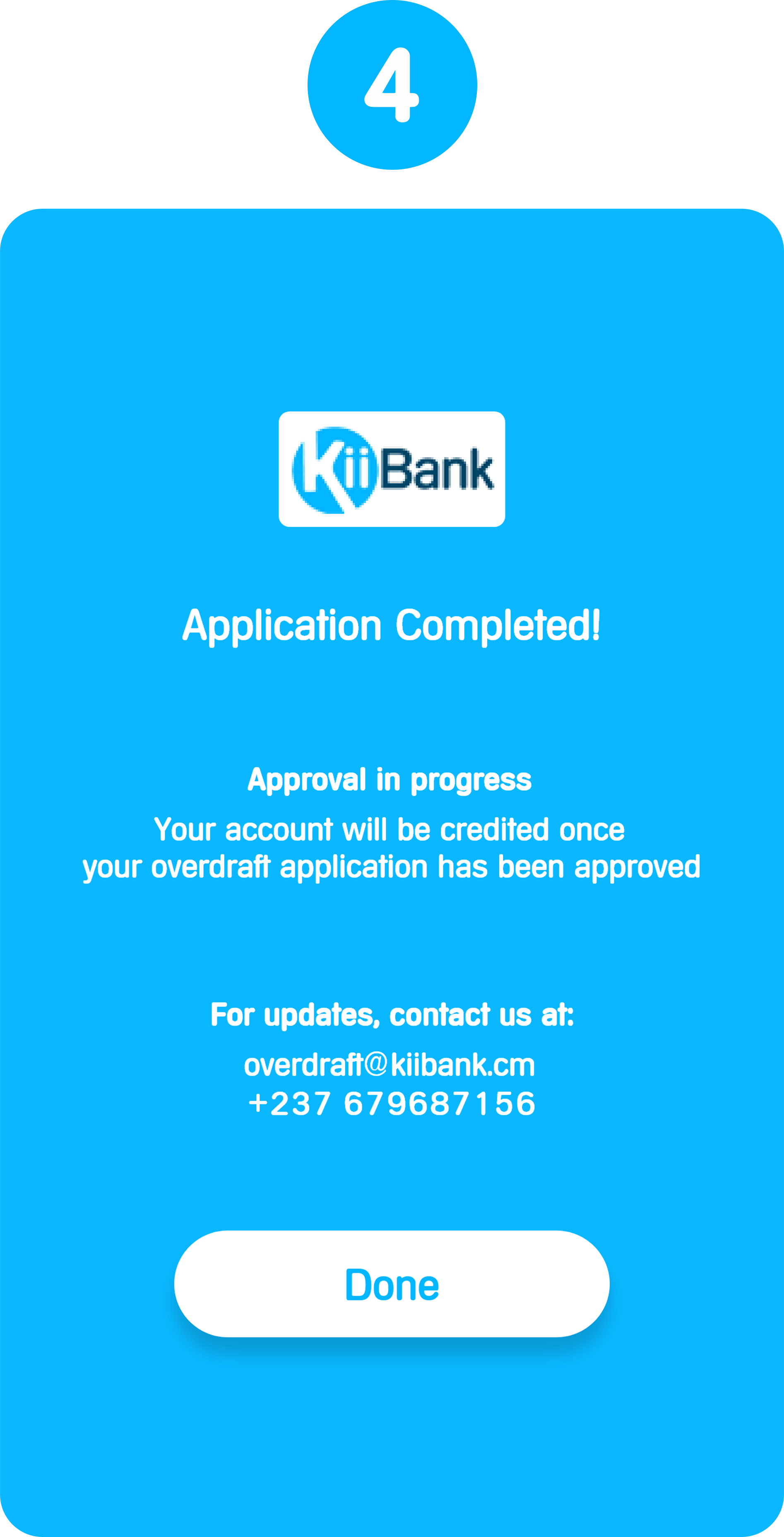

Any communications between KiiBank and you regarding the Overdraft shall be through the KiiBankin-app chat, email (loan@kiibank.cm).

You hereby authorise us to collect, save and process your information (personal or otherwise) for the purpose of this overdraft.

You further authorise us and consent to our transfer or disclosure of any information or documentation relating to the Overdraft to third parties that would require the information for the purpose of confirming your eligibility to receive the Overdraft including but not limited to credit reference agencies, collection agencies, creditors and law enforcement agencies.

You also authorise us to contact your friends, employer, relatives, or neighbours for information relating to your employment status, your telephone number or address and for any other lawful purpose connected with the Overdraft Facility provided to you.

This Offer shall be governed by and construed in accordance with the laws of Cameroon. The courts of Cameroon shall have exclusive jurisdiction in any matter arising from it.

Sign up for an account with KiiBank and upload a valid form of ID and your photo

Use your account regularly to receive money, pay for services, make transfer, etc.

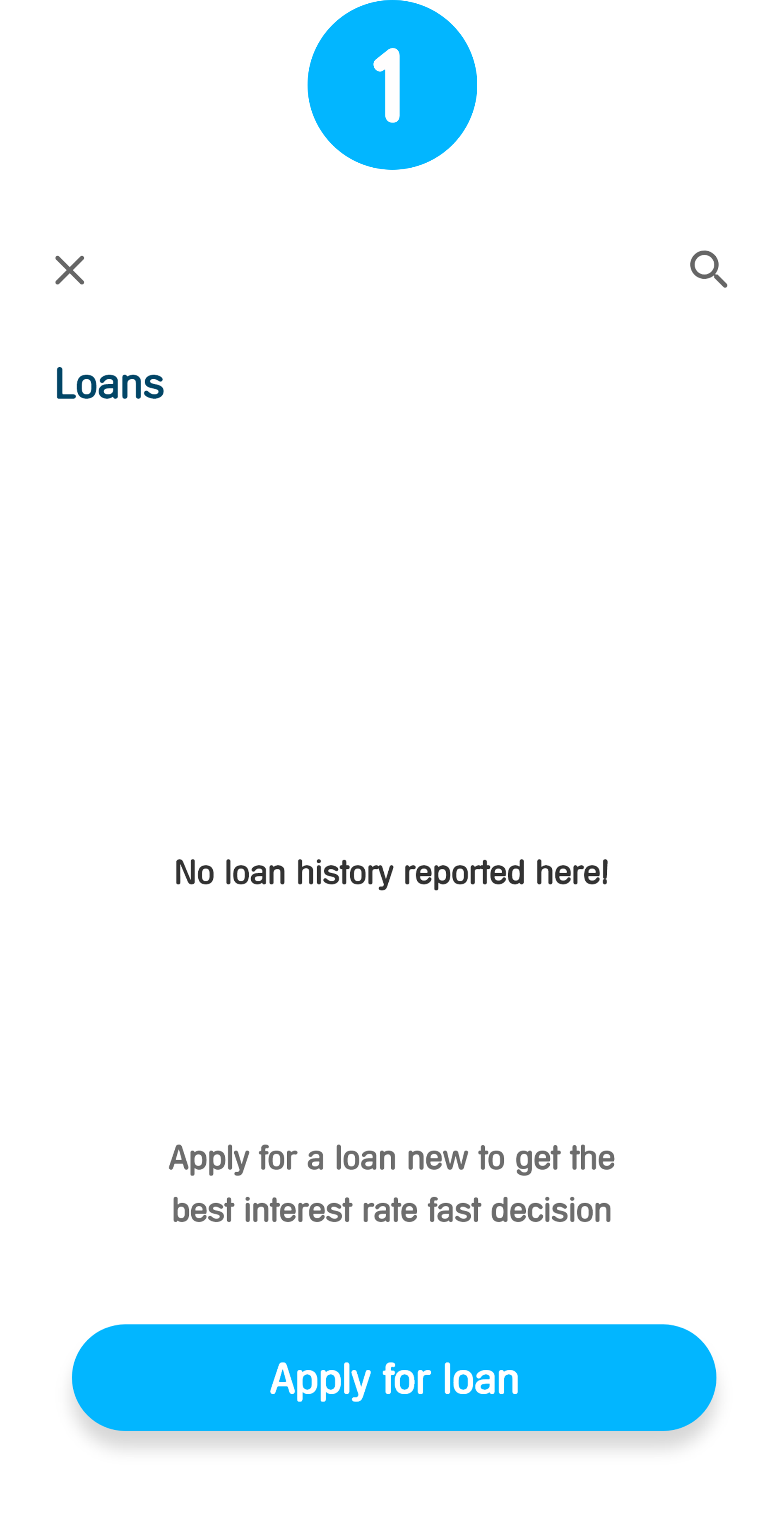

Apply for loan

You must submit an application and receive approval from KiiBank to get a loan. After approval, you will receive a lump sum based on your approved amount. You will then repay the loan back, with interest, in equal monthly instalments for the length of the loan.

Loan approval and funding can occur in as little as two days for KiiBank customers who provide a valid details when applying for the loan

Loan approval and funding can occur in as little as two days

KiiBank offers fixed term loans in amounts ranging from 5,000frs to 30,000,000 frs.

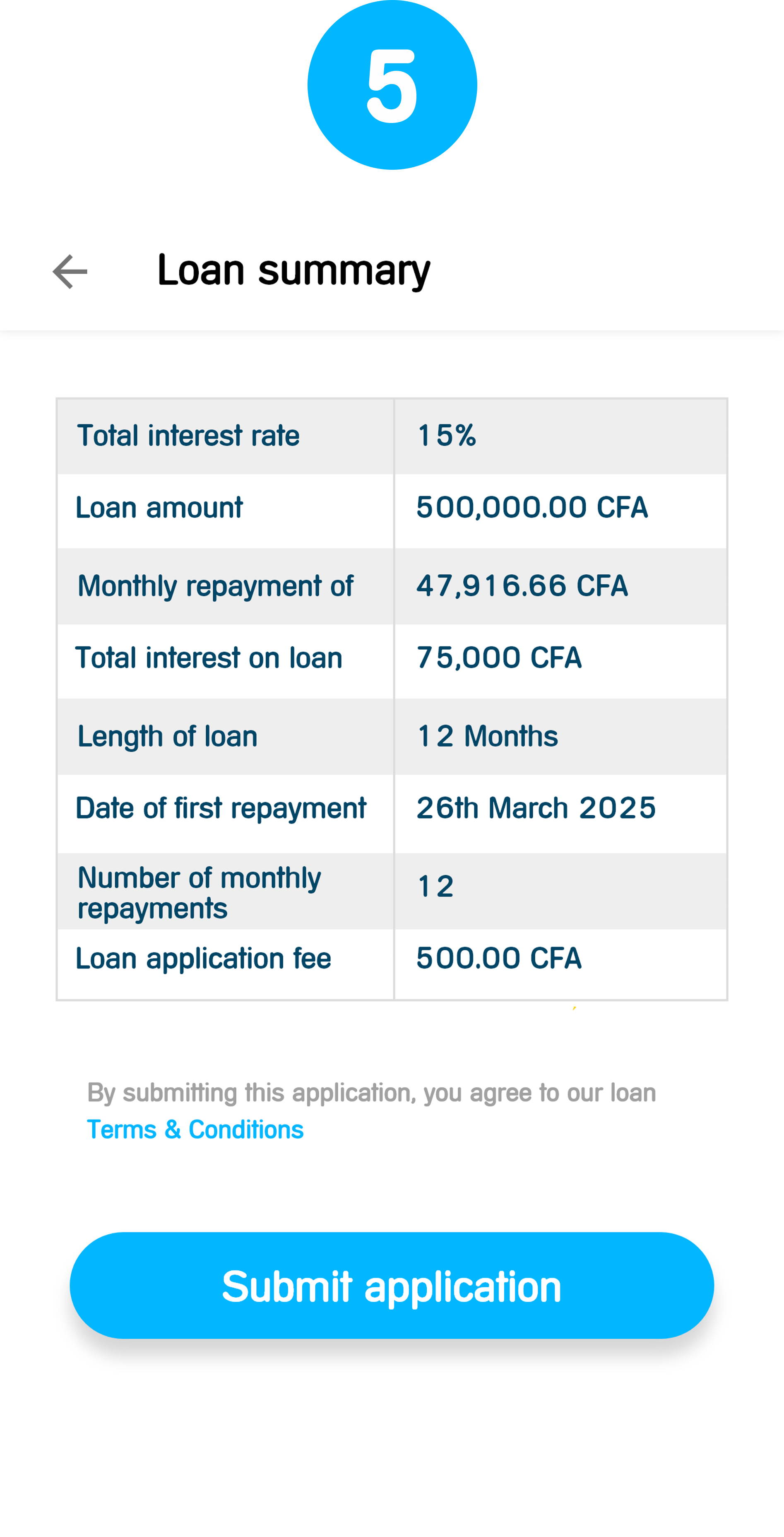

Your monthly payment is a combination of principal and interest divided evenly into monthly instalments over the term of your loan. If you are unsure of what your payment amount is, it is available on the details from your loan summary page. Your monthly payment will also be on the last page before you submit your application.

You may choose a loan term ranging from one year (12 months) up to 3 years (36 months).

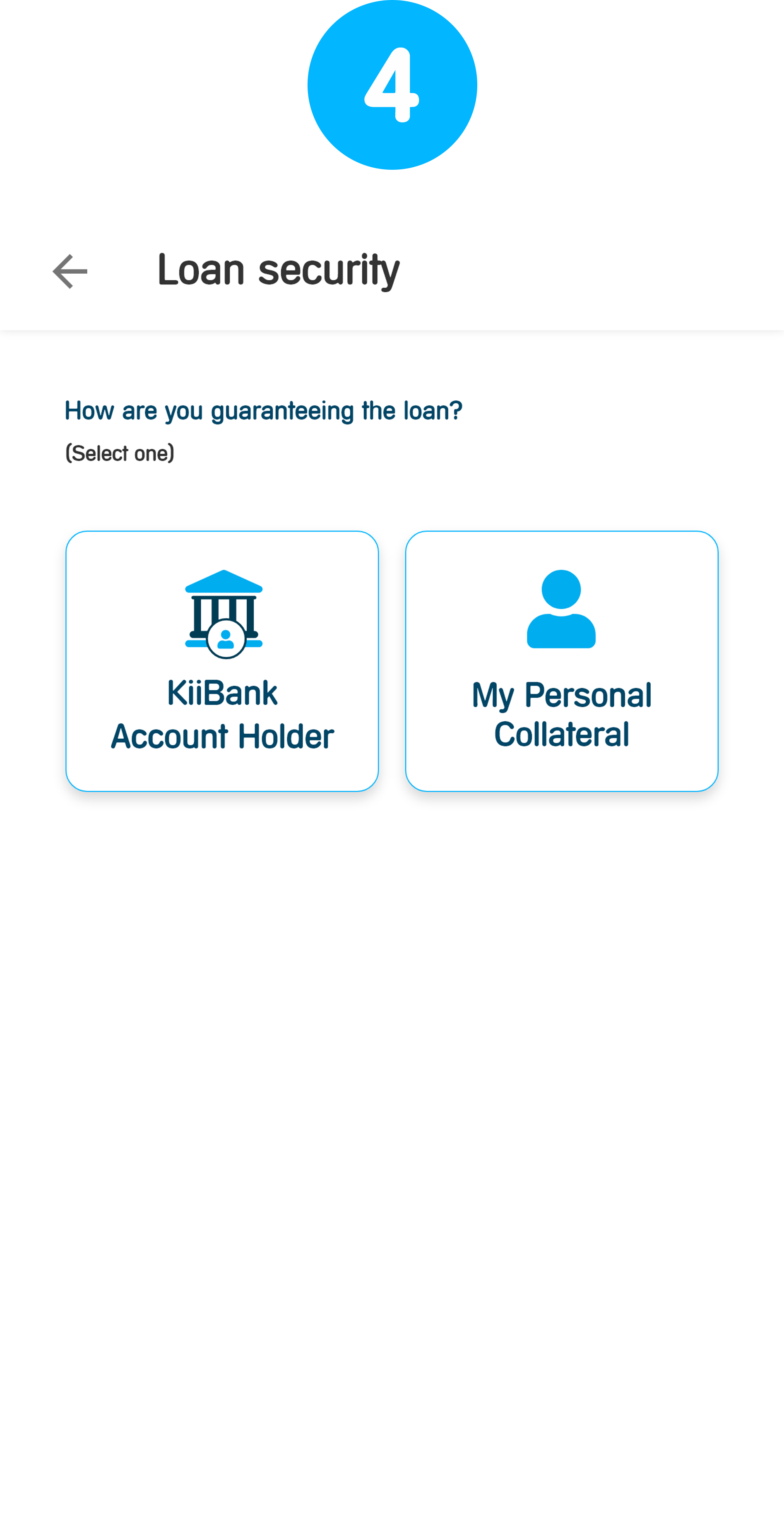

Yes, all loans must be backed by collateral which could range from a Surety (i.e. an existing account holder with KiiBank) to personal collateral.

Yes, however, your account will be automatically debited at the end of every month once your loan has been approved.

Yes, you can pay off a loan early directly from your App

Yes, you can access a variety of information about your loan from the mobile App, including:

If you are unable to make a loan payment on time, please contact a KiiBank representative as soon as possible

KiiBank will only offer you an amount that does not exceed the amount you are eligible for. If you apply to apply for a loan with us, you agree to be subjected to the terms and conditions of this letter.

We are extending this loan to you on the condition that we get a satisfactory credit report on you as well as additional verification checks. We reserve the right to cancel the loan offer if the previously mentioned checks aren’t satisfactory.

As long as the loan application has not been approved, you may cancel the application. You will not be charged any fee for this.

You must repay the loan and the Interest on or before the Maturity Date, and KiiBank is authorised to automatically debit your account on the Maturity Date to settle the loan and any accrued interests i.e. the Outstanding Balance.

If you don’t pay the Outstanding Balance in full by the Maturity Date, the loan will be treated as being in arrears and any credit in your Account will automatically be debited by KiiBank to settle your Outstanding Balance.

In addition to the above, in some instances, KiiBank might require you to repay the Outstanding Balance in full (or in part) on demand by issuing a repayment notice of at least seven (7) business days.

KiiBank will charge you interest on a monthly basis at the rate of 2.5% of the amount applied and approved. This interest will be applicable and begin to accrue as date your loan is approved - the Disbursement Date.

KiiBank represents and warrants that we are duly incorporated and licensed under Cameroon law and have taken all necessary actions to authorise our entry into this Loan Letter.

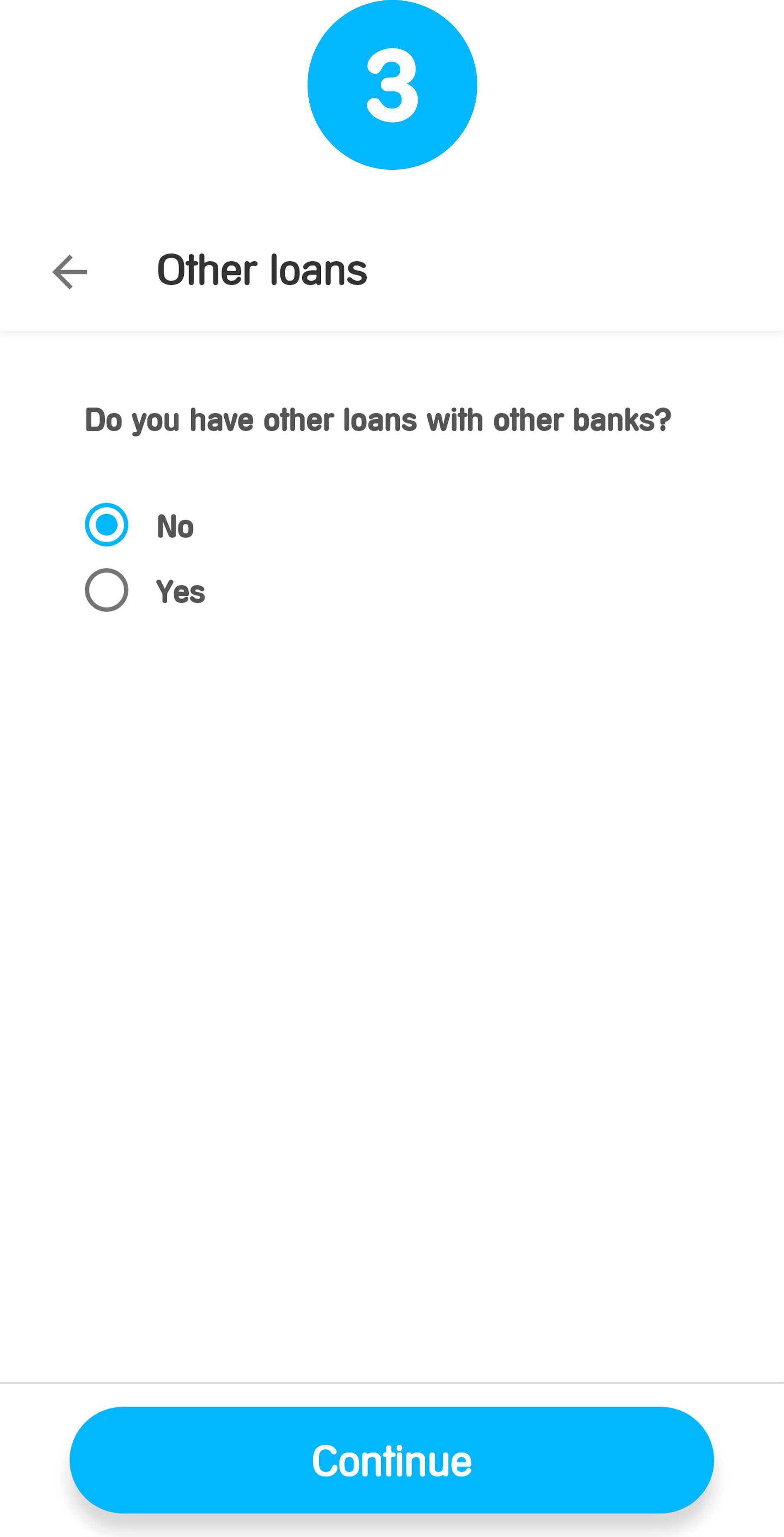

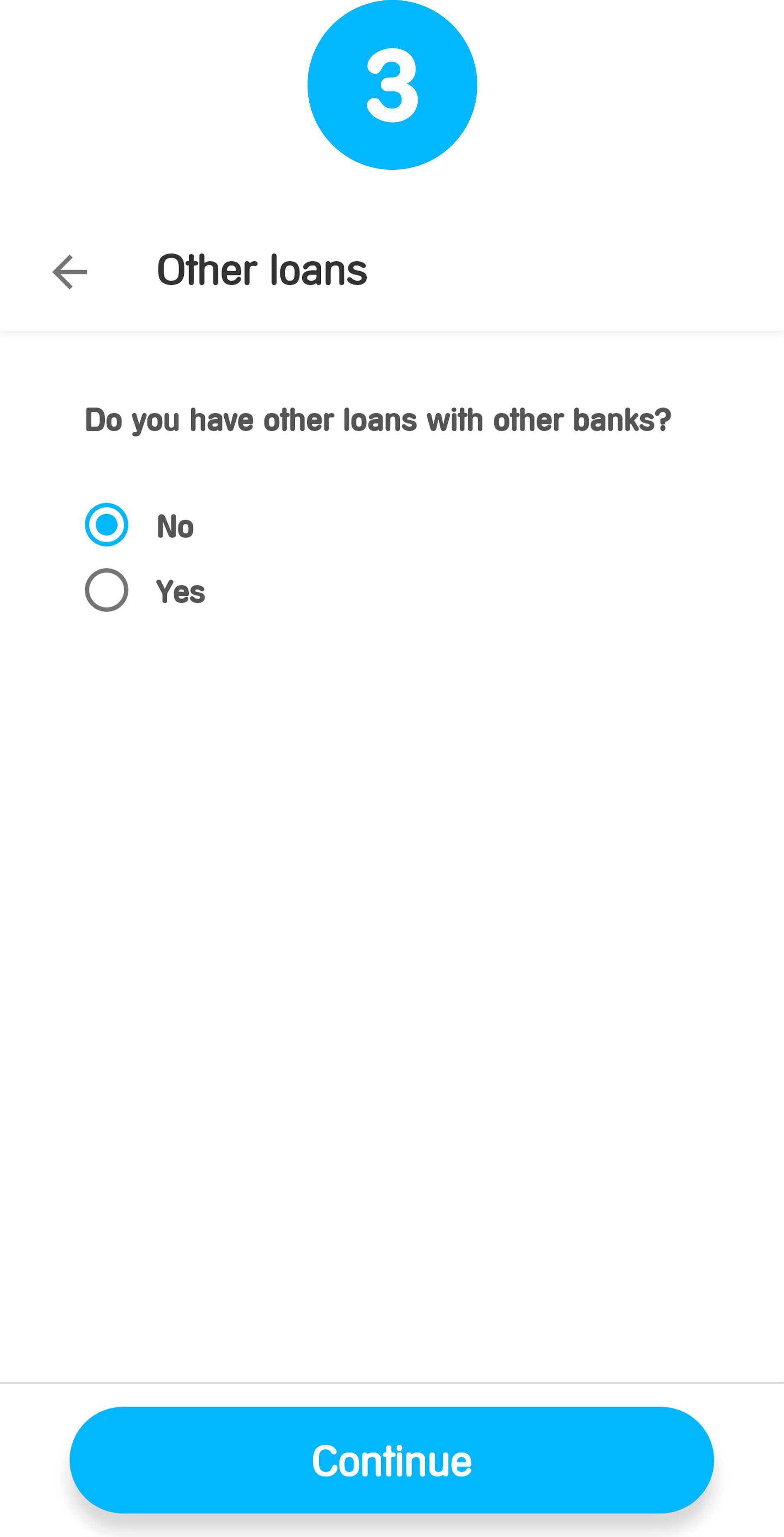

You represent and warrant that: You are not in default under any obligation in respect of any other loan that the acceptance of this loan will be or result in breach of or default under any provision of any other agreement to which you are a party; The information/documents you have provided to KiiBank via email or other electronic medium or in other form of writing as well as documents submitted in support of the Application Form for the loan is true, accurate and complete; You are in paid employment or have other verifiable means of repayment of the loan and the Interest and that should there at any relevant time (before or after the approval and draw down of the loan Facility) be a change in your employment status, you shall notify KiiBank immediately and without delay of such change.

If any of the following events occurs, the outstanding amount on your loan become immediately due and needs to be paid:

If you do not repay the loan as expected and KiiBank chooses to impose a default charge, KiiBank will notify you on the first day of default that the default charge will be applied to your account after three (3) days from the date you should have repaid the Outstanding Balance.

If you do not repay the Outstanding Balance within the Tenor, KiiBank may take legal action against you and all expenses incurred in recovery (including legal fees) will be added to the Outstanding Balance.

You hereby authorise KiiBank that, in the event that you default in repaying the Outstanding Balance on the approved loan, KiiBank will instruct the other banks/participating financial institutions about your default.

By applying and by taking the loan, you agree to repay the principal and interest when they are due.

If you fail to repay the loan and the Interest prior to the end of the Tenor, and it becomes delinquent, KiiBank has the right to report to the COBAC, MIFI or by any other means.

You agree that KiiBank has power to set-off your indebtedness under this Offer from all your account balances at other banks and from any other financial assets belonging to you in the custody of any bank.

You also agree to waive any right of confidentiality whether arising under common law or statute or in any other manner whatsoever and irrevocably agree that you shall not argue to the contrary before any court of law, tribunal administrative authority or any other body acting in any judicial or quasi-judicial capacity.

KiiBank can change, add to, delete or replace the terms of this Loan at any time and will notify you about those changes after which they shall become effective.

In the event that KiiBank varies the rate of interest payable on the loan, we will let you know ten (10) days before the implementation of the said variation.

You may not assign or transfer all or any of the rights, benefits or obligations of this loan to any other person. However, with notice to you, KiiBank may at any time assign or transfer all or any of our rights, benefits and obligations under this loan to any person.

The status of the loan will be contained in the monthly statements sent you in respect of your Account. In addition, KiiBank may also provide separate statements in respect of the loan to you.

Any communications between KiiBank and you regarding the loan shall be through the KiiBank in-app chat, email (loan@kiibank.cm).

You hereby authorise us to collect, save and process your information (personal or otherwise) for the purpose of this overdraft.

You further authorise us and consent to our transfer or disclosure of any information or documentation relating to the loan to third parties that would require the information for the purpose of confirming your eligibility to receive the loan including but not limited to credit reference agencies, collection agencies, creditors and law enforcement agencies.

You also authorise us to contact your friends, employer, relatives, or neighbours for information relating to your employment status, your telephone number or address and for any other lawful purpose connected with the Loan Facility provided to you.

This Loan shall be governed by and construed in accordance with the laws of Cameroon. The courts of Cameroon shall have exclusive jurisdiction in any matter arising from it.